Download

Abstract

Using the consensus forecasts of major banks during 1989-2022, we link inflation expectations to interest rates in 18 advanced economies. We detect horizon-increasing overreaction: high expected inflation today predicts future inflation overestimation, especially at long horizons, and higher real returns on nominal bonds, especially at long maturities. As a result, high expected inflation today predicts a future redistribution of wealth from borrowers to lenders. To understand the drivers of such redistribution, we offer a learning model where investors overweight states that are salient in memory due to their past frequency or similarity to current inflation. The model endogenizes belief under- and overreaction based on features of the inflation DGP, helping account for observed cross-country variation in belief biases and return predictability.

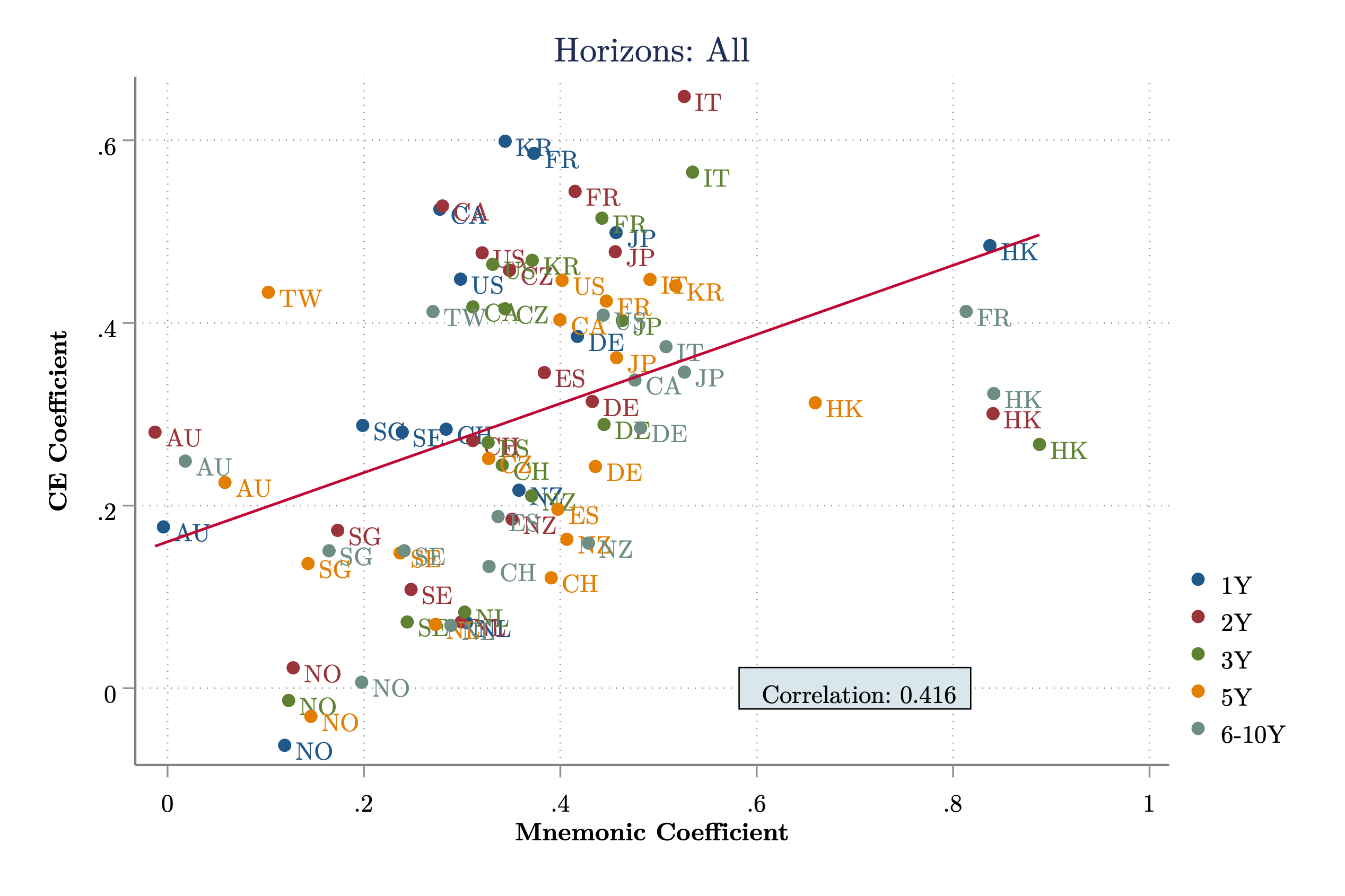

Correlation between CE and Mnemonic coefficients across horizons